IP Finance - Get a business loan using your

intellectual property

The Inngot online toolkit profiles and values your IP so banks can lend against it for IP finance

- Profile your IP assets for free

- Assess your IP's suitability for lending in just 15 minutes

- Inngot experts moderate and eligibility check your IP

- Introductions to approved suitable lending partners

- Get approved for IP finance

The three steps to IP finance

Identify & document your IP

Uncover all the IP you own using our FREE online tool Goldseam. This is the first step to IP finance

Determine suitability for a loan

Your IP profile and business are moderated and eligibility checked for IP finance by our in-house team of experts

Signposting to lenders

Based on the suitability of your IP profile we will put you in touch with our lending partners that offer IP finance using the Inngot IP toolkit

Featured IP finance lenders

High Growth IP Loan

If you're a business that has potential to grow, you're already growing fast, or maybe you're a bigger business looking to scale up, then we could help you to really go places.

Hover for more information

NatWest High Growth IP Loan

Targets: SMEs and scale ups experiencing high growth

Preferred reports: Goldseam, Sollomon, Hallmarq

HSBC Growth Lending

UK scale-ups are the fastest growth area in the economy, contributing 33% of GDP, according to the ONS. We estimate that 30% of these are tech firms and we want to help them grow.

Hover for more information

HSBC Growth Lending

Targets: Technology-driven growth businesses

Preferred report: Goldseam, Sollomon

Inngot - your lending partner for IP finance

Goldseam® IP profile, Sollomon® IP valuation and Hallmarq™ collateral suitability check

Inngot's reports are used by a growing number of lenders to establish IP value to inform the credit decision process for IP finance. That's because they recognise that the most valuable assets growth businesses have are the intellectual property and intangible assets (IP) that they create and own.

Unlock the value in your IP and raise finance!

What is IP-based lending or IP finance?

Your IP and intangible assets are valuable. IP finance allows you to use that value as security

IP finance secures the loan using your intellectual property and intangible assets as an alternative to physical collateral or personal guarantees.

The real appeal for IP-rich companies is that you can use your IP to raise the funds you need for growth, rather than giving away shares in your company.

Video courtesy WIPO

How does IP finance work?

Generally, a lender will take a charge over your IP

The kind of deals on offer from lenders can vary widely, depending on their chosen lending product and the rules that apply in different countries.

Companies wanting to take advantage of IP finance or IP-based lending will need to be able to show the value of their IP to their day-to-day operations.

Inngot’s IP toolkit makes identifying and valuing IP simple and affordable for all businesses and is accepted by leading lenders as the ‘gold standard’ in IP valuation.

WIPO and Intangible Asset Finance:

Moving Intangible Asset Finance from the Margins to the Mainstream

Who can apply for IP finance?

Companies with IP and intangibles that are genuinely core to their income streams can apply for IP finance

- Do you have registered or unregistered IP rights that are core to your business?

- Can you show existing and future revenue streams from products or services that use your IP?

- Is your business growing by 20% or more a year?

- Can you afford the IP loan repayments?

Quick answers about IP finance

The main condition all lenders will apply is that your IP needs to be in active use, supporting current sales of your products or services. The types of IP that can be considered vary according to the lender’s policies, but the ones we deal with won’t require you to have granted or pending patents – trade marks, designs and revenue-producing copyright materials can all be acceptable.

Many bank loans involve taking a security interest (in the UK, a charge) over your IP and intangible assets. The difference with IP finance is that the lender gives active consideration to the strength, importance and value of these assets when determining whether to offer you a loan, and how much you can borrow. As intangible value can’t be determined from your accounts, specialist assessment and valuation is always required to do this, and we are the experts.

The number of lenders taking an active interest in IP finance is growing all the time. Give us a call or send us an e-mail telling us who you currently bank with, and we’ll advise on the current status of your lender.

Inngot is the only company to have built online systems that deal specifically with lender requirements. Our profiling, assessment and valuation reports give banks all the key information they need in a consistent, convenient format, and none of the ‘flab’ they don’t. We don’t presume to tell banks how to do their job; instead, we facilitate their consideration of the IP-specific aspects, pinpointing and valuing the assets that can be used as security.

To apply for an IP finance and receive an IP loan, you need to be able to explain what IP you own, why it might make good security for lending, and how much it is worth. Inngot is not a finance provider or broker; our role is to provide standardised, consistent methods of profiling, assessment and valuation to produce all the reports you will need to share with an IP finance lender.

Yes, of course! You can call us on +(44) 333 800 8090, book a call or email us via our contact page.

Inngot's toolkit has helped businesses around the world

Identify and unlock

28,000+

previously hidden assets

Demonstrate

$1.4 billion

in IP value

Raise up to

$5 million

finance per company

Tools to help you secure IP finance

Use our online toolkit and custom services to get a detailed understanding of your IP and intangibles

ONLINE TOOL

1. Discover your IP and intangibles for FREE

Identify and uncover your IP with Goldseam®

Inngot’s FREE online tool Goldseam is the fastest and easiest way to identify, describe and document your company's IP rights and other identifiable intangibles.

ONLINE TOOL

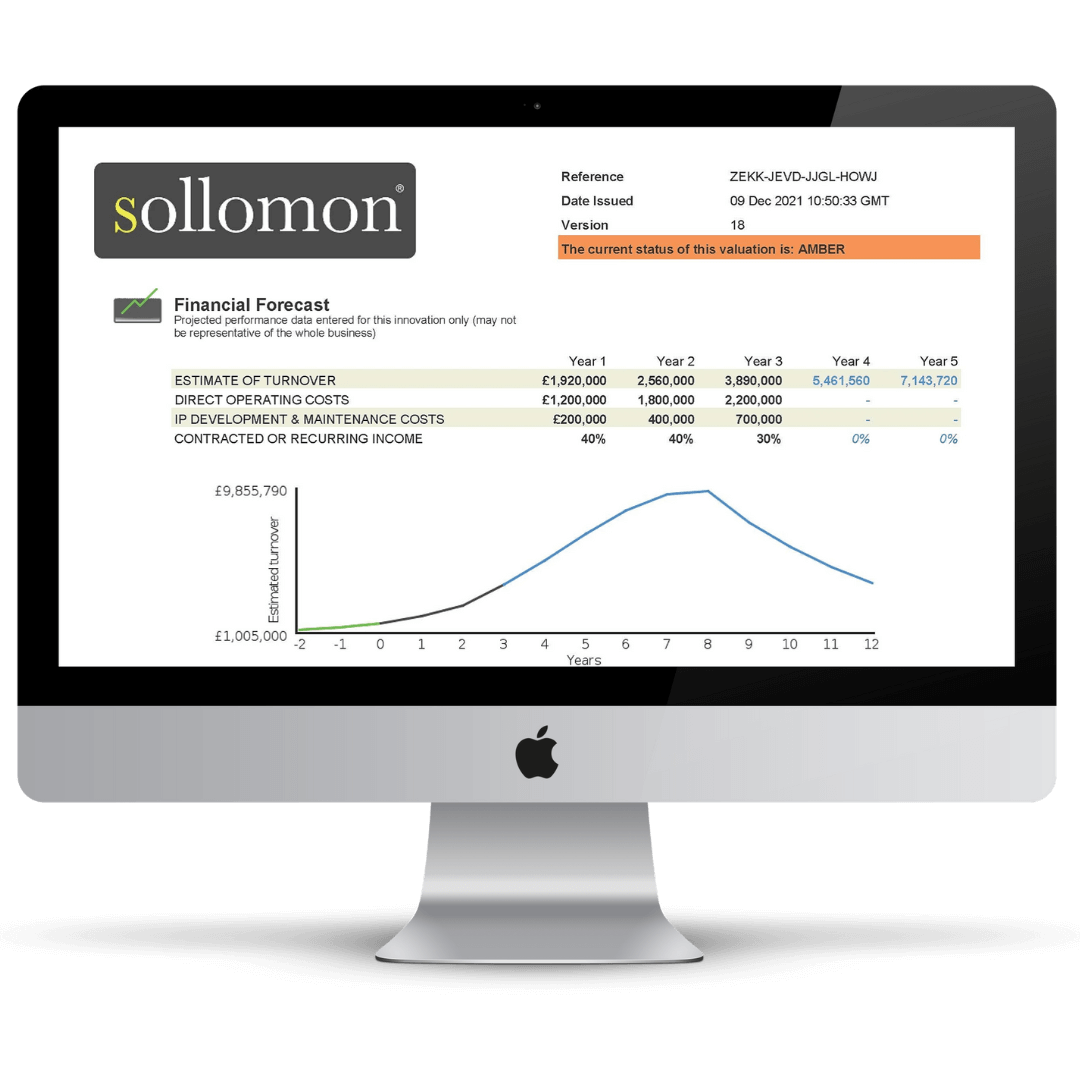

2. Easily value your IP and intangibles

Generate an instant IP valuation report

Our unique online tool Sollomon® allows you to value your IP at a fraction of the cost of traditional IP valuations in line with recognised international standards.

Fully integrated with Goldseam, Sollomon is simple and intuitive for any trading business to use.